- NEW YORKBASED SMARTASSET 110M TTV CAPITAL PROFESSIONAL

- NEW YORKBASED SMARTASSET 110M TTV CAPITAL FREE

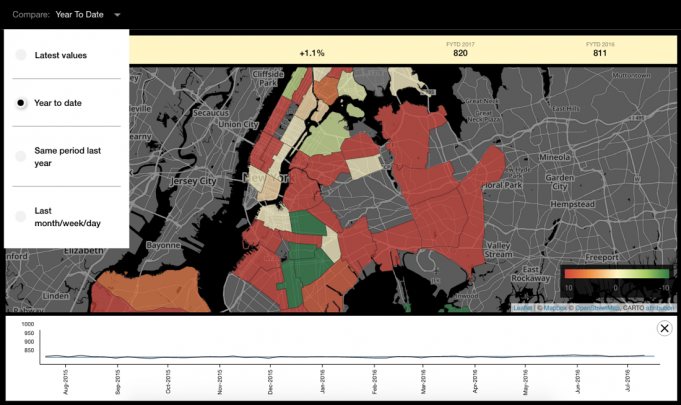

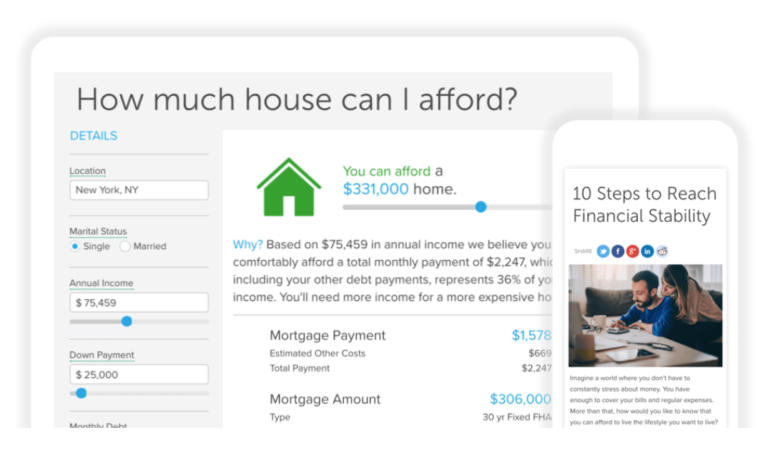

See: Betterment rolls out free baseline human advice. SmartAsset's decision to start closely managing the referral process also reflects the tendency for erstwhile digital-only advisor servicers to bite the bullet and add humans to the mix in search of improvements. Until now, SmartAsset relied on third-party advisors to close the leads.īut - also like Personal Capital - SmartAsset is now reaching that 10-year mark, a benchmark when investors get itchy about seeing killer results. Personal Capital closes the leads itself. It churns the Internet with free tools for investors. SmartAsset uses an approach similar to Personal Capital for procuring leads. SmartAsset declined to reveal whether Focus, a client as well as an investor, will use its new phone connection service. Focus led the last funding round, two years after SmartAsset pivoted to serving RIAs. Since its 2012 founding, SmartAsset has brought in $51.4 million in venture capital backing over six rounds. That said, SmartAsset declined to say whether its new dial-a-lead 'live connections' service has continued to achieve the same success rate since its Apr. See: What exactly is it about SmartAsset's Zillow-for-RIAs play that converted Focus Financial? Reaping the rewards?īut the firm's new return on investment will actually be even higher because SmartAsset plans to charge three times more.įor instance, in order to get connected with a prospective client with more than $1 million in investible assets, advisors have to shell out $645 per lead. This figure is based on in-house data, confirmed by advisors at RIAs and broker-dealers. Over the last two years, SmartAsset leads have delivered $9.7 billion in fresh assets under management (AUM) for advisors, according to the firm. "We expect to help financial advisors add an aggregate $10 billion in assets under management in 2020," says Mark LoCastro, SmartAsset's director of public relations, via email. SmartAsset currently refers roughly $5 billion a year to advisors, but by adding human brokering to the process, it expects that amount to double. The company, however, is basing its projections on a pilot program that included about 100 advisors at RIAs and broker-dealers - and one that makes clear what the payoff will look like. The New York-based startup - now eight years past its founding - is betting that injecting trained staff into the mix will take the number of SmartAsset leads advisors convert from one in 20 to one in five, according to Michael Carvin, the firm’s co-founder and CEO. Mark LoCastro anticipates a near doubling of SmartAsset's annual referrals to RIAs. With the venture capital clock ticking, SmartAsset is making its biggest gamble yet, turning leads into RIA AUM by using call center people to fix a low-close digital process.

It'll be a huge ninth year at the company if it can execute on that bet. In the firm's pilot, the results were an order of magnitude better than digitally belching out prospective leads. Now comes stage II clinical trials on a much larger number of investors and advisors. But now it is injecting a human aspect - people on the phone - to impart urgency, do vetting and ensure conversations actually happen. More than 65 million investors were going to its site each month with little follow up. SmartAsset made it this far by playing to its non-human strengths-a massive numbers game. I think for that reason companies that have tried to make a business off the very personal interaction of a referral have really found it difficult. After all, they don't want to let down the common friend.

NEW YORKBASED SMARTASSET 110M TTV CAPITAL PROFESSIONAL

Whether the professional who takes on your business likes you or not, they are likely to serve you well. First of all, you have reason to believe your referring friend has your best interests at heart. Brooke's Note: Whether you are hiring a plumber, a veterinarian or a financial advisor, your preferred introduction is a referral from somebody you know and trust.

0 kommentar(er)

0 kommentar(er)